iowa homestead tax credit calculator

Property Tax Exemption Application. Part 15 Pre-Application Meeting Offers feedback that will enable you to prepare better applications for the Part 2 submittal.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-02-6e3072bd99d74ee4a0492e799e21560b.jpg)

How To Calculate Return On Assets Roa With Examples

Property units are contiguous parcels that have the same classification owner usepurpose and are located in the same county.

. What is a Homestead Tax Credit. For additional information and for a copy of the application please go to the Iowa Department of Revenue web site. The credit will continue without further signing as long as it continues to qualify or until is is sold.

Ad Free tax calculator for simple and complex returns. No homestead tax credit shall be allowed unless the first application for homestead tax credit is signed by the owner of the property or the owners qualified designee and filed with the city or county assessor on or before July 1 of the current assessment year. Law.

Applicants must own and occupy the property as a homestead on July. How much is the homestead tax credit in Iowa. July 1st Any commercial industrial or railroad property owner is eligible for the credit.

In other words claimants aged 70 years or older with higher household income are able to qualify for the property tax credit in 2022. Guaranteed maximum tax refund. Once you have this information you can work out a capital gains tax calculator to give yourself a good idea of what your capital gains tax.

Learn About Sales. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on household income for claimants aged 70 years or older. Persons in the military or nursing homes who do not occupy the.

July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. For assistance call the Scott County Treasurer at 563-326-8664. Ad Homestead Tax Credit Iowa.

Part 1 - Evaluates the buildings integrity and significance and project eligibility. Equals the Net Taxable Value divided by 1000 multiplied by the Tax Levy Rate and rounded to the nearest cent. If you live in Palm Beach County in a house valued at 370000 after the homestead your property taxes are 4851 based on the average tax rate of 1311 percent.

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. Once a person qualifies the credit continues until the property is sold or until the owner no longer qualifies. Find the capital gains tax rate for each state in 2020 and 2021.

New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. Parcels with an Agricultural Class of at least 10 acres in size qualify for the Ag Land Credit. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of Net Taxable Value.

Part 2 - Evaluates that the proposed. The homestead credit is calculated by dividing the homestead credit value by. Iowa Property Tax Apply.

In order to qualify a service member must have served on active duty during a period of war or for a minimum of 18 months during peacetime. New applications for homestead tax credit are to be filed with the assessor. Get Ready for Tax Season Deadlines.

To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Find and Complete Any Required Tax Forms here.

How do I estimate the net tax for a residential property with Homestead and Military Tax Credit. January 8 2021 356 PM. This exemption is a reduction of the taxable value of their property amounting to a maximum.

Disabled Veterans Homestead Tax Credit. This application must be filed or postmarked to your city or county assessor by july 1 of the year in which the credit is first claimed. Equals 100 Actual Value multiplied by the appropriate Rollback Rate.

Know the basics when it comes to capital gains tax. Learn About Property Tax. 701801425 Homestead tax credit.

In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the. This handy calculator helps you avoid tedious. Adopted and Filed Rules.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Property owners must sign with the City or County Assessor and qualify under standards set by the State of Iowa. Homestead tax credit code of iowa chapter 425 originally adopted to encourage homeownership through property tax relief.

This Property Tax Calculator is for informational use only and may not properly indicate actual taxes owed. Premium federal filing is 100 free with no upgrades. This benefit reduces a veterans assessed home value for property tax purposes by 1852.

File a W-2 or 1099. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. 8011 Application for credit.

Homeowners may qualify and sign for a Homestead Exemption with the city or county assessor. The credit is applicable to individual parcels as well as property units. CACTAS stands for Tax C redit A ward C laim and T ransfer A dministration S ystem and refers to the online system supporting the tax credit administration responsibilities of IDR and other State agencies that facilitate tax.

Homestead Tax Credit Sign up deadline. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. For most taxpayers the Homestead Credit equals 4850 divided by 1000 multiplied by the Tax Levy Rate multiplied by 77.

If you live in a house with the same evaluation in Miami-Dade County you will pay 4736 in property taxes based on a rate of 1280 percent. Other credits or exemptions may apply. In 2021 the Iowa legislature passed SF 619.

The Military Tax Credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or Iowa National Guard who served at least 20. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Tax Credits.

The State of Iowa historic tax credit program consists of six mandatory steps. Calculate your tax refund for free. Credits and exemptions are applied only to annual gross net taxes total.

This credit reduces the value on which taxes are calculated by a maximum of 4850. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. Discover Helpful Information And Resources On Taxes From AARP.

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. Homestead Tax Credit Iowa. Contiguous parcels share a common boundary or.

5154809388 REMAX Concepts 661 NE Venture Drive Waukee IA 50263. Welcome to CACTAS. Ad Calculate your federal income tax bill in a few steps.

The homestead credit is a tax credit funded by the state of iowa for qualifying homeowners and is based on the first 4850 of net taxable value.

Is Life Insurance Taxable Forbes Advisor

5 Best Mortgage Calculators How Much House Can You Afford

Should You Move To A State With No Income Tax Forbes Advisor

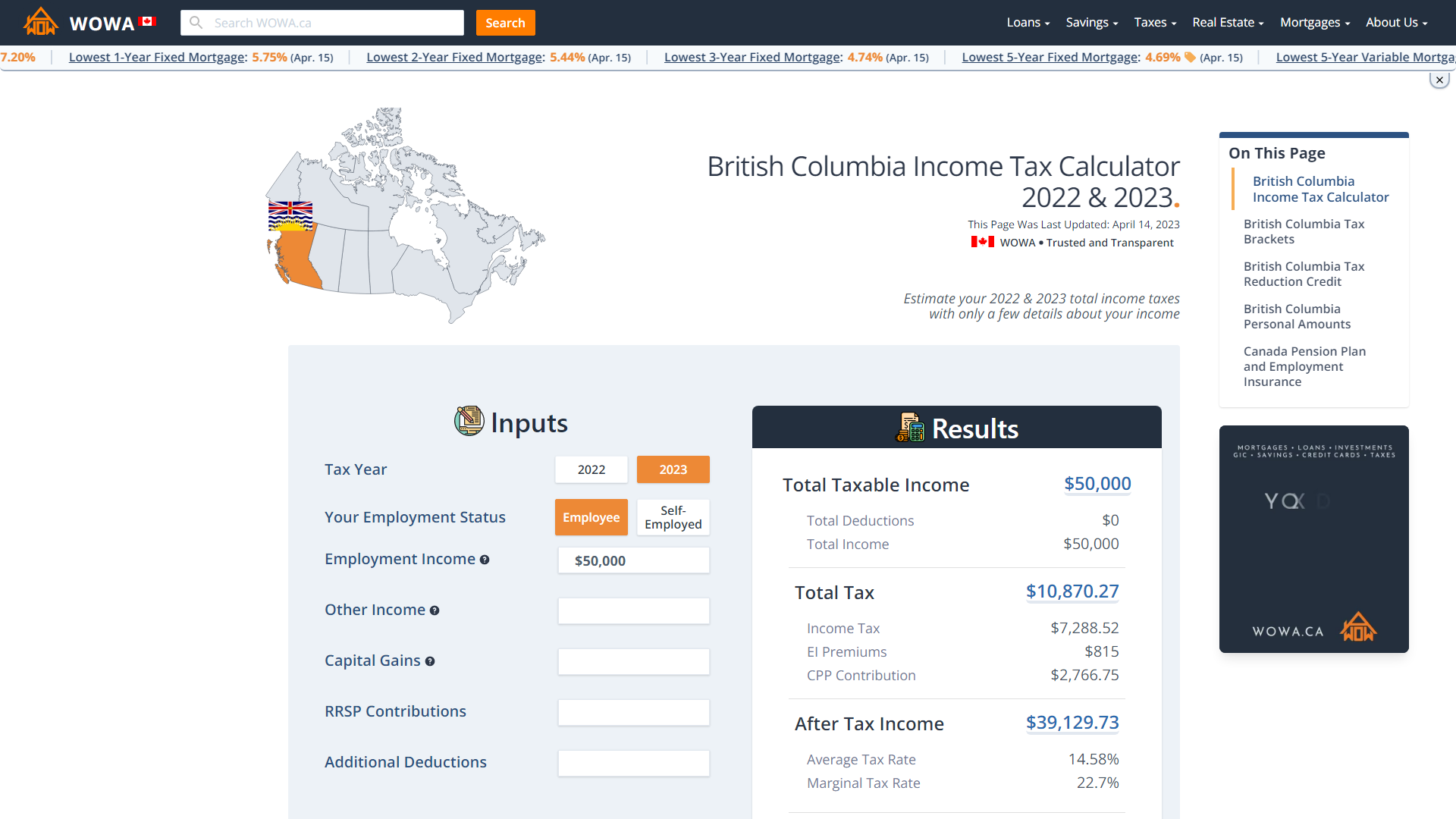

Bc Income Tax Calculator Wowa Ca

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

How Long Does It Take Solar Panels To Payback For The Cost

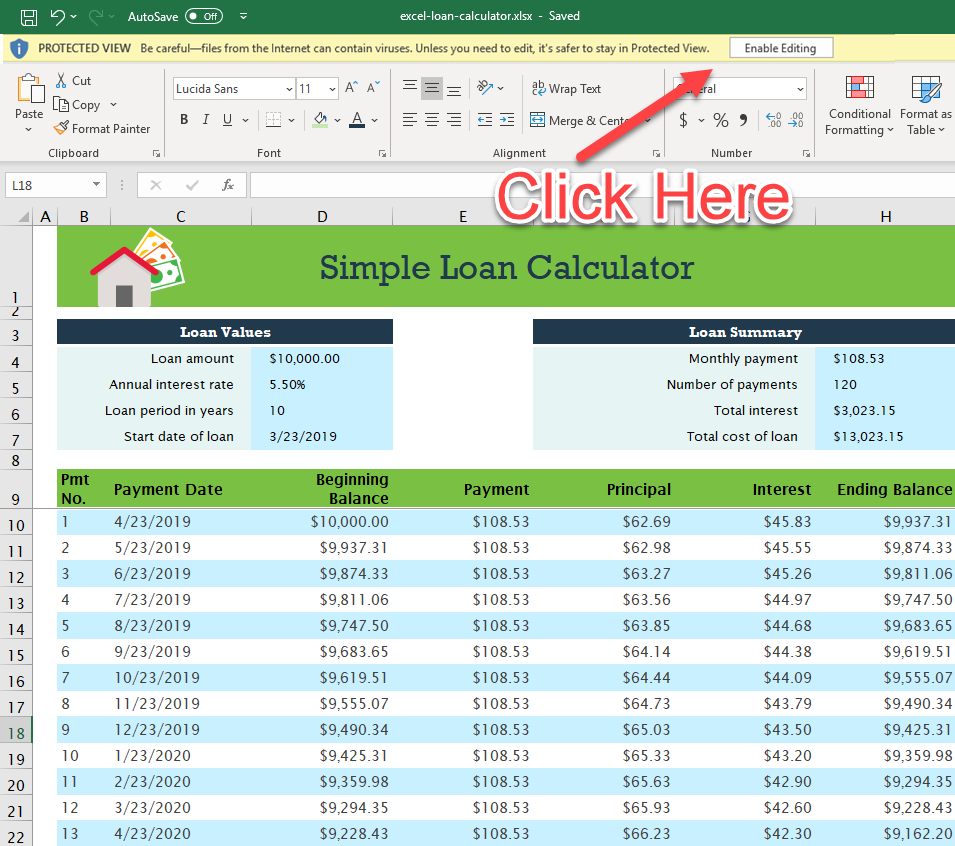

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

How To Calculate Capital Gains Tax H R Block

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

Capital Gains Tax Calculator 2022 Casaplorer

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Gst On Real Estate Purchase Rates Rebates Exemptions Bridgewell

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

2021 Capital Gains Tax Rates By State

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Tax Deductions